Two weeks ago, SpaceX launched it’s third successful mission placing 60 more Starlink satellites into low earth orbit, bringing the total number of global internet powering satellites to 180. That is far from the planned system completion threshold of 12,000, but it does establish that SpaceX has the formula down and isn’t going to stop any time soon. While 12,000 may be a few years away, Elon Musk, founder and CEO of SpaceX, has stated that 400 satellites would provide “minor” internet coverage and 800 satellites would achieve “moderate” or significant operational” coverage. Each subsequent launch of 60 satellites would deliver 1 terabit of bandwidth, potentially supporting 40,000 users streaming ultra-high-definition content at once. It’s safe to say with numbers like those, internet from space is going to be a house hold topic for years to come.

Musk has stated that one of the primary reasons for creating the Starlink system was to bring low cost internet to all areas of the globe and to give traditional telecommunication companies more realistic competition. Everyone is familiar with how current telecom companies have monopolized local areas, establishing themselves as the only viable internet options in the process. But how will competition work with space internet? There aren’t any wires in run in space, so can there be infinite companies providing service through satellites?

…Unfortunately not. As nice as it would be to have that must increased competition for telecom services, available bandwidth will limit how many services can operate at any given time. The Federal Communications Commission (FCC) allocated Ku-band (12 – 18 GHz) frequencies as the approved operation bandwidth for delivering high speed internet from satellites. Ku-band has been the standard for satellite communication for decades due to its higher potential data volume and cost efficiencies over C-band systems. But to get transmit speeds that are sufficient for high speed internet, you need to utilize a significant portion of the available bandwidth allocated by the FCC.

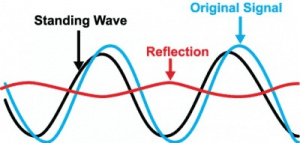

There are currently 3 companies with serious plans to have high speed internet from space: SpaceX, Softbank’s OneWeb, and Keplar communications. With three separate internet systems beaming down from space there is a potential risk of in-line cross interference if they happen to get to close to each other. Fortunately, the FCC knew this would eventually be an issue and created a rule at the turn of the millennium that would establish a priority system based on which companies had operational systems first. The rule states that in the event of an in-line cross of two satellites or on the ground operators, the highest priority company would choose a half of the available bandwidth to use, and the second highest company would get the half that wasn’t chosen. This rule worked well for the time as there were only 2 companies trying to get into space, Teledesic and Skybridge, and the FCC concluded that in-line crossing would only occur 6% of the time. What happens if there is a third satellite interfering though? Well, by the FCC’s rules, they would only be able to operate in whatever scraps the other two weren’t using. This would cause sever service degradation or even loss of service. To further compound the issue, the FCC’s estimate of in-line cross interference only happing 6% only accounted for a few thousand satellites at the most, not the tens of thousands that are planned to be utilized today. As it stands now, there could potentially only be 2 functioning satellite internet systems operating with enough connectivity to claim they are “High Speed”.

The FCC is already working on new rules to try and solve this problem. One possible solution could be to limit the available bandwidth for each company thus capping the data they could transmit. Another potential resolution could be to move some or all satellite internet traffic to Ka-Band (26.5 – 40 GHz). Ka-Band operates in a larger bandwidth and at a much higher frequency which allows data to be transferred at higher volumes in a shorter amount of time than possible in Ku-Band. This also has a edge in cost with an average bandwidth cost of $200 – $400 per megabits per second per month (Mbps) compared to an average cost of $800 – $1400 Mbps for Ku-Band. Ka-Band is not without its drawbacks though—he higher frequency makes it more susceptible to interference of all kinds and its coverage is smaller compared to Ku-Band.

Whatever the FCC decides to do, it will lay the groundwork for how commercial to user satellite communication takes place for decades to come.

_______________________________

NuWaves Rf Solutions RF and Microwave Design Services team has a broad range of experience working in bands between VHF/UHF to Ka. Consider NuWaves’ team for your next project or design consultation.